Posted in: Public

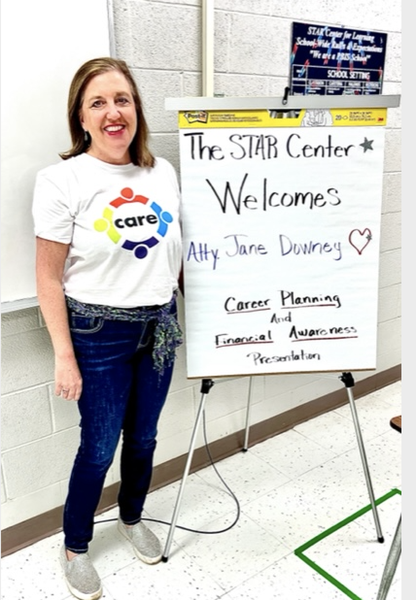

The South Carolina Bar is pleased to share some important Credit Education Awareness Month information and tips from Consumer Law Section Council member, Jane Downey. Downey, a partner at Moore Bradley Myers in West Columbia, was named as one of the 2022 500 Leading U.S. Bankruptcy and Restructuring Lawyers as well as a member of the Board of Directors for Credit Abuse Resistance Education (CARE) by the American Bankruptcy Institute.

National Credit Awareness Month Tips:

- Before starting college, don’t take 100% of the student loans offered to you; instead, take only what you must have to cover school expenses. A good rule of thumb is not to take out more than your projected 1st year salary.

- Set a budget and review your spending habits regularly. Determine your needs vs. wants and save money for the things that you can instead of putting everything onto credit cards and loans.

- Minimize credit debt by having only one or two credit accounts; pay off your balance monthly and never charge more than 30% of your credit limit.

- Set auto pay where applicable. Late payments can do serious damage in a short amount of time.

- Check your credit report regularly. You can check your credit score at annualcreditreport.com at no cost and no harm to your credit. If you find an error on your credit report, dispute it as soon as possible with the three credit bureaus online. They have 30 days to resolve the issue and get back to you.

- Plan for emergencies by putting 10% of your paycheck into savings and if your company offers a retirement plan match, try to contribute the maximum amount.

- As a rule, don’t borrow on one card to pay down another. Instead, reach out to the credit card company to inquire about an interest free repayment plan. If you must consolidate debt, see which credit card has the highest rates and begin there.

- Always read the fine print: look for the annual fee and the interest payments that could be hidden in the offer you receive.

Beginning July 1, the three main credit reports may exclude your outstanding medical debt from your credit report.

“A credit report is like your financial report card," Downey said. "Your credit scores can impact your ability to buy a home or to start your own business. So, monitoring and managing your finances is key! When in doubt, speak with an attorney for guidance. The SC Bar is a great resource and hosts free legal clinics with experienced attorneys in all parts of the state.”